Our Pacific Prime Diaries

Table of ContentsSome Known Details About Pacific Prime The 3-Minute Rule for Pacific PrimeFascination About Pacific PrimeEverything about Pacific PrimeAll about Pacific Prime

Insurance policy is a contract, stood for by a plan, in which an insurance policy holder gets economic protection or repayment against losses from an insurance coverage firm. The majority of people have some insurance: for their auto, their house, their health care, or their life.Insurance additionally helps cover expenses related to obligation (legal responsibility) for damages or injury caused to a 3rd party. Insurance is an agreement (policy) in which an insurance provider compensates one more versus losses from particular contingencies or perils. There are numerous sorts of insurance plan. Life, wellness, house owners, and car are amongst one of the most usual forms of insurance policy.

Investopedia/ Daniel Fishel Many insurance policy kinds are readily available, and essentially any kind of private or organization can locate an insurance business eager to guarantee themfor a cost. Usual individual insurance coverage policy kinds are auto, wellness, home owners, and life insurance policy. A lot of people in the USA contend least among these sorts of insurance coverage, and automobile insurance is needed by state law.

The Definitive Guide to Pacific Prime

So finding the cost that is right for you requires some research. The plan limit is the maximum amount an insurer will certainly spend for a covered loss under a plan. Optimums might be established per period (e.g., annual or policy term), per loss or injury, or over the life of the policy, additionally referred to as the lifetime maximum.

Plans with high deductibles are normally cheaper since the high out-of-pocket cost usually leads to less tiny insurance claims. There are several types of insurance coverage. Let's look at one of the most vital. Health insurance coverage helps covers regular and emergency situation healthcare expenses, typically with the alternative to add vision and oral services independently.

Numerous preventative services may be covered for totally free prior to these are satisfied. Health and wellness insurance coverage might be purchased from an insurance business, an insurance coverage agent, the federal Wellness Insurance policy Market, given by an employer, or government Medicare and Medicaid coverage.

The smart Trick of Pacific Prime That Nobody is Discussing

The business then pays all or most of the covered prices associated with a car crash or various other vehicle damage. If you have actually a rented car or obtained money to get a car, your loan provider or leasing dealership will likely require you to lug vehicle insurance coverage.

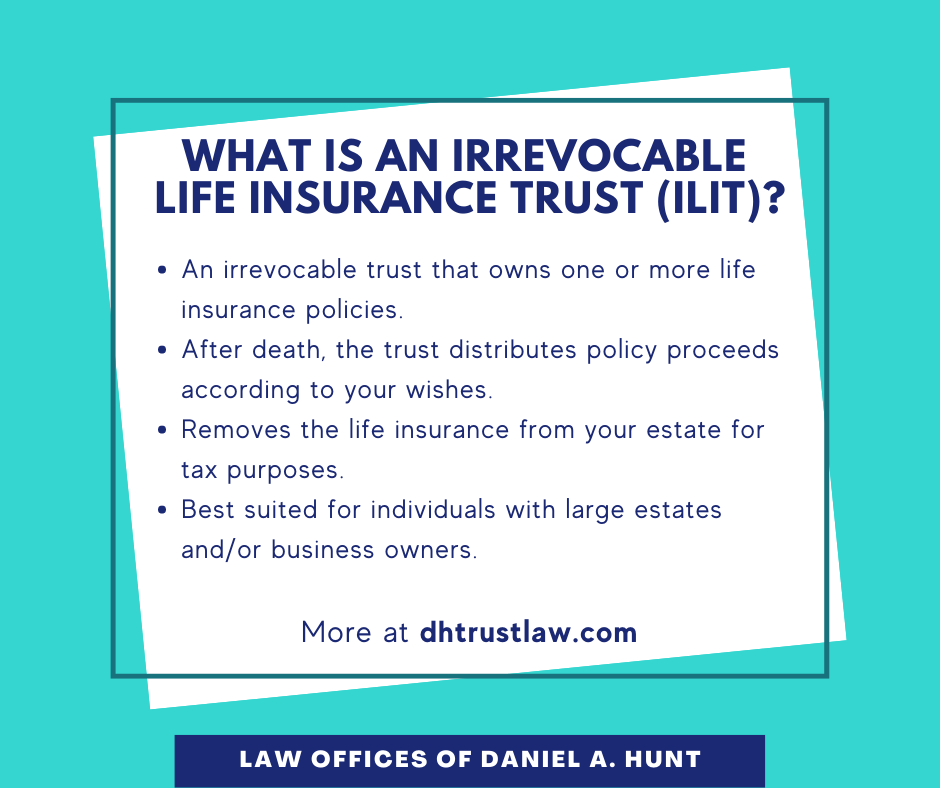

A life insurance policy policy guarantees that the insurance firm pays a sum of money to your beneficiaries (such as a spouse or kids) if you pass away. In exchange, you pay costs throughout your lifetime. There are 2 major kinds of life insurance policy. Term life insurance policy covers you for a details period, such as 10 to two decades.

Long-term life insurance policy covers your entire life as long as you proceed paying the costs. Traveling insurance coverage covers the expenses and losses connected with taking a trip, including trip cancellations or delays, insurance coverage for emergency healthcare, injuries and evacuations, damaged baggage, rental cars, and rental homes. However, also some of the best travel insurer - https://www.ted.com/profiles/46568975 do not cover cancellations or delays as a result of weather, terrorism, or a pandemic. Insurance policy is a way to handle your financial threats. When you purchase insurance coverage, you acquire protection against unanticipated monetary losses.

Not known Details About Pacific Prime

There are numerous insurance coverage policy types, some of the most usual are life, health and wellness, property owners, and auto. The best kind of insurance policy for you will depend on your objectives and financial situation.

Have you ever before had a moment while considering your insurance coverage plan or looking for insurance policy when you've assumed, "What is insurance? And do I actually need it?" You're not the only one. Insurance can be a mysterious and perplexing thing. How does insurance coverage job? What are the advantages of insurance coverage? And exactly how do you locate the very best insurance for you? These prevail inquiries, and thankfully, there are some easy-to-understand responses for them.

Nobody desires something poor to occur to them. Yet suffering a loss without insurance can place you in a hard economic situation. Insurance policy is an essential monetary tool. It can help you live life with fewer concerns knowing you'll get economic help after a calamity or crash, assisting you recoup much faster.

What Does Pacific Prime Do?

And in many cases, like vehicle insurance and workers' compensation, you might be needed by law to have insurance in order to secure others - international health insurance. Discover ourInsurance choices Insurance policy is basically a big nest egg shared by lots of people (called policyholders) and taken care of by an insurance policy service provider. The insurance coverage company utilizes money collected (called premium) from its insurance holders and other investments to spend for its operations and to accomplish its pledge to policyholders when they sue